Last updated on July 28th, 2023 at 01:49 pm

A Mexican Sociedad Anonima (S.A.) is a legal entity with two or more shareholders (owners). The owners have their liability limited to the amount of capital they invested in the company. It is a stock corporation. Therefore it issues stock of shares to the owners. Also, these shares are negotiable. This means owners can sell and buy them freely. Another key point is that the S.A. is the Mexican equivalent of the American Corporation. Indeed, it is the most widely used type of company in Mexico.

In addition, you may find that the words de Capital Variable or de C.V. follow the Sociedad Anonima or S.A. But this only means the company can increase and reduce its capital stock. It does this by admitting new shareholders or asking current owners for more money.

At Start-Ops Mexico, we help foreign companies get established in Mexico hassle-free. Accordingly, one of our clients’ most recurring questions is, what legal entity should I incorporate? The answer in 98% of the cases is either a Sociedad de Responsabilidad Limitada (S. de R.L.), the Mexican LLC, or a Sociedad Anonima (S.A.). In sum, this article will give you all the information you need to understand if an S.A. is the proper structure for your business.

Be it as it may, please contact us if you still have questions. You can also check our Ultimate Guide to Start a Business in Mexico for more information on relocating your business to Mexico.

Sociedad Anonima General Information

First of all, federal law regulates all types of companies in Mexico. Specifically, General Mercantile Corporations Law or Ley General de Sociedades Mercantiles in Spanish regulates them. Specifically, the fifth chapter, On Sociedad Anonima, specifies all the regulations this type of corporation must comply with. Hence, all of the information in this article has its legal basis in that law. As with any other company, the SA must be incorporated by a Public Broker or a Public Notary in Mexico.

Sociedad Anonima Key Facts

- Owners are referred to as shareholders.

- There has to be a minimum of two shareholders.

- It can have an unlimited amount of shareholders.

- Shareholders have their liability limited to their stock investment.

- Since 2011 there has been no mandatory minimum capital requirement. However, it’s always a good idea to keep it within business standards.

- Capital and ownership are represented in share certificates, e.g., 1,000 shares.

- Each share has equal value and equal rights.

- Shares are traded freely.

- A Sole Administrator or a Board of Directors manages the company.

- All S.A. corporations must have at least one Statutory Auditor appointed by the shareholders.

- Ordinary General Shareholders’ Meetings are mandatory once a year.

- Extraordinary General Shareholders’ Meetings vote to decide on special matters.

Corporate Management in a Sociedad Anonima

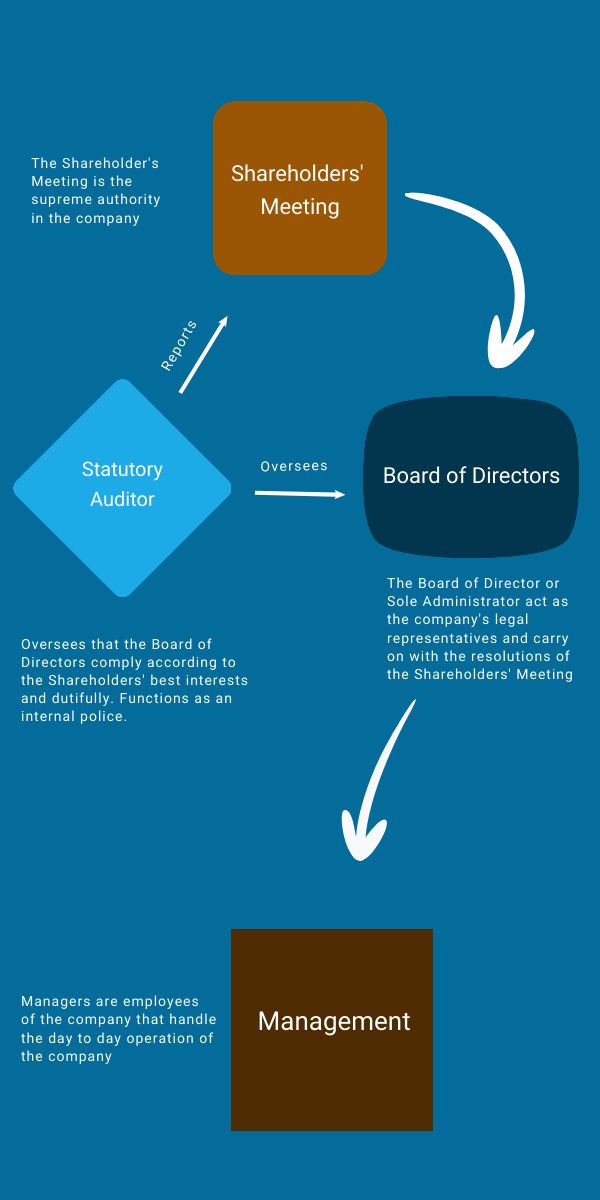

Undoubtedly, Shareholders are the supreme authority that governs an S.A. They generally exercise this authority by making decisions at Shareholders’ Meetings. These meetings can be either Ordinary, for regular business decisions, or Extraordinary, for special decisions.

Secondly, the Sole Administrator or Board of Directors directs the company. As a result, they implement the decisions taken by the Shareholders’ Meeting. Indeed, they are responsible for the company’s management and administration.

Meanwhile, a third party, the Statutory Auditor, oversees the activities of the Sole Administrator or Board of Directors. The Shareholders appoint him specifically to protect their interests. Indeed, one of his functions is ensuring the Directors are doing their work correctly.

The corporate hierarchy in an S.A. looks like this.

Shareholders’ Meetings

The Shareholders exercise their authority by making decisions at Shareholders’ Meetings. There are two different types of meetings:

- Ordinary Shareholders’ Meetings

- Extraordinary Shareholders’ Meetings

Ordinary Meetings are for regular business decisions, and Extraordinary Meetings are for special decisions.

Ordinary Meetings Matters

- Approve the Sole Administrator’s annual report. They take the auditor’s report into account to do it.

- Appoint the Sole Administrator, Board of Directors, and Statutory Auditors (if needed).

- Set the pay of the Sole Administrator or Board of Directors and the Statutory Auditor (if not specified in the by-laws).

Some Extraordinary Meetings Matters

- Dissolve the company.

- Increase or reduce the capital. If you wish to ask current shareholders for more money, an extraordinary meeting must occur.

- Change the purpose of the company (what the business does).

- Transform the company into a different legal entity.

- Merge the company with another company.

- Issue shares.

- Issue bonds (debt).

- Modify the deed of incorporation.

- Anything else that requires a special quorum.

As you can see, Extraordinary Meetings are indeed for extraordinary decisions. The critical difference is the quorum (the minimum number of shareholders present). Ordinary meetings require a quorum of 50%, and this cannot be modified. Extraordinary meetings require a quorum of 75%, given the importance of the decisions voted. With these meetings, the quorum can be modified up to 100% if shareholders wish. This is done in the articles of incorporation. In both cases, resolutions are passed by a majority vote.

The number of shares each individual represents determines the quorum and votes. Remember, each share has one vote. If one shareholder has 50% of the shares, he automatically represents this proportion in quorum and votes.

Shareholders may have someone represent them in the meetings, except Directors (or Sole Administrator). A proxy letter grants representation to other individuals. We can help draft and formalize it.

Board of Directors

The second tier in a Sociedad Anonima corporate management is the Sole Administrator or Board of Directors. From now on, we will refer to them as just the Board of Directors for simplicity.

The Board of Directors acts as the company’s legal representative. They are in charge of managing its day-to-day operation. Directors (or the Sole Administrator) can be shareholders simultaneously. Or they can be outsiders to the company. Foreigners can perfectly function as Directors as long as they have a visa. They don’t need a work permit. The articles of incorporation establish their responsibilities and power. This may be changed if needed.

The Board of Directors is responsible for delivering an annual report to the shareholders’ meeting that includes:

- Company’s annual performance, current projects, and current policies.

- The main accounting policies and criteria used.

- Financial statements showing the situation of the company with explanatory notes.

Statutory Auditor

All S.A. companies must have, by law, at least one Statutory Auditor. Shareholders designate this person to oversee the Board of Directors. Their task is to make sure they comply with their best interests. Think of it as internal police. The Statutory Auditor reports to the Shareholders the activities the Board of Directors performs. This is a big responsibility.

The main difference between a Sociedad Anonima and a Sociedad de Responsabilidad Limitada is the mandatory figure of a Statutory Auditor. An S.A. is meant to be a corporation with many members. So it enforces a Statutory Auditor to protect the Shareholders’ interests. The S. de R.L., on the other hand, is meant to be for smaller groups of members, so it does not enforce it.

Some of the responsibilities of the Statutory Auditor are:

- They make sure monthly financial corporate reports are delivered.

- Oversee the corporation’s activities.

- Issue an annual report. This includes his opinion on accounting practices.

- Call ordinary or extraordinary shareholders’ meetings when required.

- To attend these meetings.

There are certain limitations to being a Statutory Auditor. Since the position oversees a group of individuals, there shouldn’t be conflicts of interest. Usually, the position is held by an independent auditing firm or the company’s accountant. If needed, Start-Ops can function as your Statutory Auditor.

None of the following can act as a Statutory Auditor.

- Employees of the company

- Direct blood relatives of Directors

Management

The Board of Directors acts more strategically. So, to run the day-to-day operations, they usually hire a manager (or more). Managers are employees of the company. So, for a foreigner to be a manager, he must obtain a residency. Ideally, the articles of incorporation define the powers granted to the said manager, but it is also possible to grant a new manager power to act on behalf of the company through a Power of Attorney.

When to Incorporate in a Sociedad Anonima

The Sociedad Anonima is similar to the American Corporation. As you can probably see, the legal structure of an S.A. is aimed toward having many owners. This may include minorities, which are protected by the law to an extent. The whole structure has mechanisms to settle disputes between its parties. Understandably this is made to coordinate larger groups of people.

Your decision depends on the type of operation you will have in Mexico. The Statutory Auditor, for example, represents an extra cost. If only two shareholders trust each other and both will be appointed Directors, this figure doesn’t make sense.

The S.A. is great for cases where the company’s owners will be many, and the Directors will be outsiders to the organization. Then, overseeing their performance and activities truly makes sense. If you are planning, for example, to raise equity from investors, it may be a good idea to incorporate in a Sociedad Anonima.

I hope this article helped. If you have any questions please leave them in the comment section below. And remember to share the article if you know someone that may find it helpful. Sharing is caring!